Investing in property is often seen as a savvy way to boost your long-term wealth. But, if you’re thinking about becoming a landlord, there are three taxes you need to factor into your plans to avoid an unforeseen bill.

Property prices have steadily increased in recent decades, so it’s not surprising that people are considering property investments. Even after short-term downturns in the market, such as the one that followed the 2008 financial crisis, property prices have recovered.

The average UK house price at the start of 2013 was almost £168,000, according to Land Registry data. A decade later, it had increased to more than £288,000. So, historically, property investors have had the opportunity to generate a sizeable return.

Of course, as well as the property increasing in value, landlords hope to receive a regular income from tenants too.

High inflation and stock market volatility mean more people are thinking about how they could use property to improve their long-term financial wellbeing. A report in FTAdviser suggests a quarter of savers plan to invest in property to support their retirement goals.

Before you move ahead with plans to purchase a buy-to-let property, there are lots of pros and cons you should weigh up first. Among the areas to consider are the taxes associated with buying a second property and being a landlord, including these three.

1. Stamp Duty

When buying a second property, the first tax charge you’re likely to need to pay is Stamp Duty.

This is a tax you pay when purchasing property or land. There is usually a 3% Stamp Duty surcharge when buying a second property, including a property you intend to use as a buy-to-let.

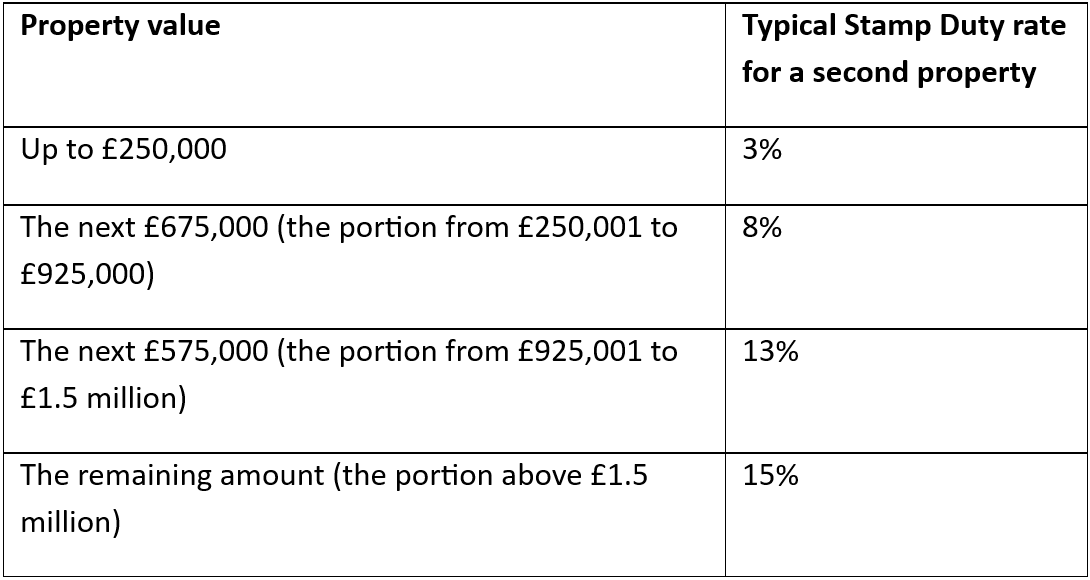

For 2023/24, the Stamp Duty tax rates for a second property in England and Northern Ireland are:

The government’s Stamp Duty calculator can help you understand what charge you may need to pay.

You should note, Scotland and Wales have similar taxes when purchasing property. However, the thresholds and rates are different.

Normally, you’ll need to pay any Stamp Duty due within 30 days from the completion of the purchase. As a result, it’s essential that you’ve calculated the bill and included it in your budget for buying a buy-to-let property.

2. Income Tax

If you’re renting out a property, you’ll usually pay Income Tax on the profit.

The profit you make will be added to any other income you receive, such as your salary. So, the rate of Income Tax you pay as a landlord will depend on which tax bracket you’re in. You should be mindful of property income pushing you unexpectedly into a higher tax bracket.

There are potentially ways to reduce your Income Tax bill as a landlord. However, allowances are not as generous as they were in the past, so it’s important to calculate your expected bill when deciding if investing in property is right for you.

You can deduct “allowable expenses” from your rental income when calculating profit. These expenses must be wholly and exclusively for the purpose of renting out the property.

You could, for example, deduct general maintenance work, like repairing a leaking roof, treating damp, or replacing existing fixtures and fittings. However, you cannot deduct improvements, such as switching laminate kitchen countertops for high-end granite ones.

It’s also no longer possible to deduct mortgage expenses from your rental income to reduce your tax bill, although you may receive a tax credit on 20% of your mortgage interest payments.

So, while there may be ways you can reduce Income Tax on the rental yield, you could still face a significant bill that you need to weigh against the profit.

3. Capital Gains Tax

When you’re thinking about investing in property, you may not have considered when you’ll sell it or the tax charge you could face when you do. However, it’s a crucial part of understanding if buy-to-let makes financial sense for you.

You pay Capital Gains Tax (CGT) when you make a profit when you sell certain assets, including property that isn’t your main home. The CGT rate depends on the rate of Income Tax you pay and the size of your gain. For residential property, it can be as much as 28%.

The CGT annual exempt amount could provide you with a way to reduce the bill when you sell buy-to-let property. In 2023/24, you can make a profit of up to £6,000 before CGT is due. In 2024/25, the CGT exempt amount will halve to £3,000.

Keep in mind that the CGT exempt amount covers gains made when you sell some other assets too. So, if you’ve sold shares for a profit during the same tax year, you’ll need to consider how this would affect your CGT exempt amount and your overall bill.

Calculating CGT can be complex, and seeking tailored financial advice can be useful.

Do you have questions about buy-to-let mortgages?

There are some key differences between traditional and buy-to-let mortgages. If you’re considering buying a buy-to-let property and have questions, from how much you could borrow to how much the repayments could be, please contact us.

Please note:

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Buy-to-let (pure) and commercial mortgages are not regulated by the Financial Conduct Authority.

Your property may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.